Ira required minimum distribution worksheet

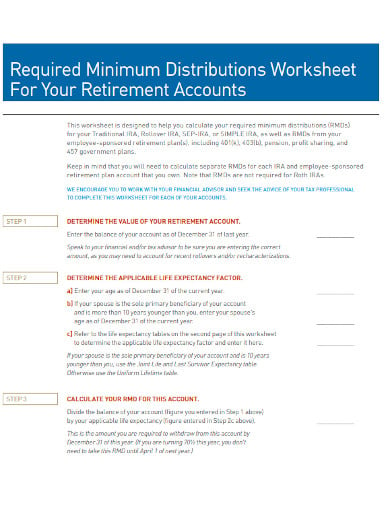

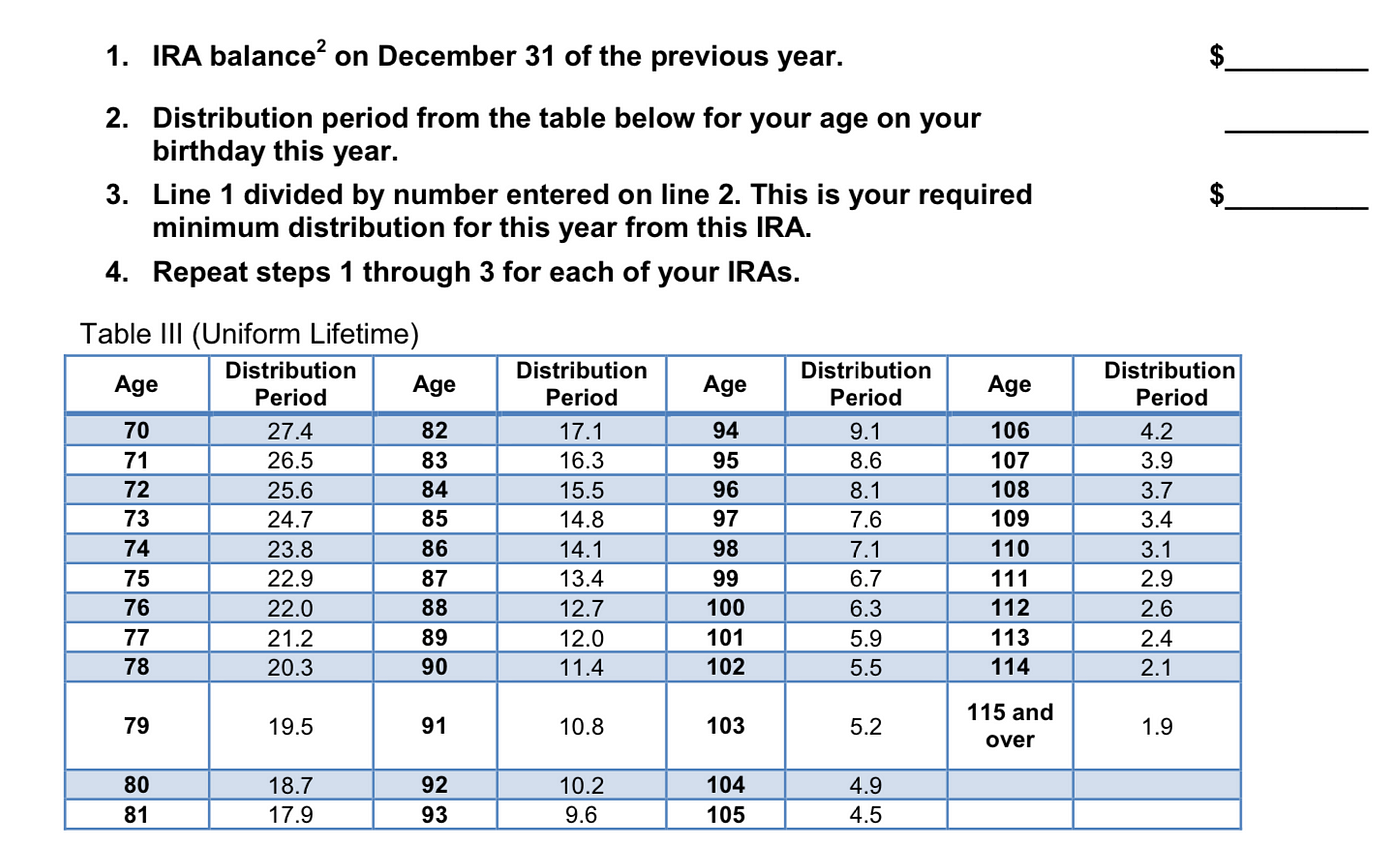

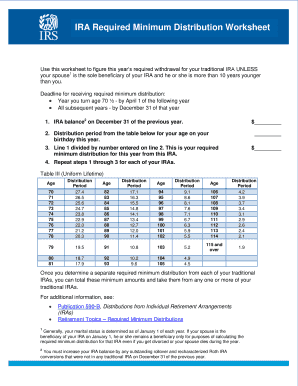

IRA Required Minimum Distribution Worksheet Use this worksheet to figure this years required withdrawal for your traditional IRA UNLESS your spouse1 is the sole beneficiary of your IRA and he or she is more than 10 years younger than you. Use a Roth conversion to turn your IRA savings into tax-free RMD-free withdrawals in retirement.

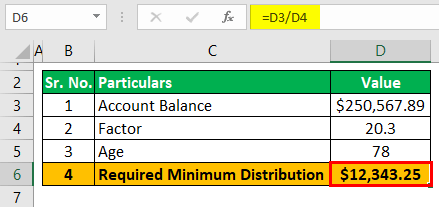

Required Minimum Distribution Calculator Estimate Minimum Amount

Thats because on November 6 the IRS released new life expectancy tables that are used to calculate RMDs.

. IRA Required Minimum Distribution Worksheet If your spouse1 is the sole beneficiary of your IRA and he or she is more than 10 years younger than you use this worksheet to calculate this years required withdrawal for your traditional IRA. Use this calculator to determine your Required Minimum Distribution RMD from a traditional 401k or IRA. So you lose the tax-free growth on.

Minimum required distributions start at age 70 12. A Roth IRA is an individual retirement account IRA under United States law that is generally not taxed upon distribution provided certain conditions are met. RMDs are waived for 2020 and.

The principal difference between Roth IRAs and most other tax-advantaged retirement plans is that rather than granting a tax reduction for contributions to the retirement plan qualified withdrawals from the Roth IRA plan. In general your age and acc. If you have earned income for the current tax year that does not exceed the income limits previously mentioned you can contribute the lesser of 6000 7000.

Minimum required distributions start at age 72. You can look forward to somewhat smaller required minimum distributions RMDs from your IRA and company retirement savings plan beginning in 2022. Traditional IRAs force you to take required minimum distributions RMDs every year after you reach age 72 age 70½ if you attained age 70½ before 2020 regardless of whether you actually need the money.

10 early withdrawal penalty 25 for the first two year of plan participation if under age 59 12 exceptions may apply. RMDs are calculated using the life expectancy tables issued by the IRS in Publication 590-B. Deadline for receiving required minimum distribution.

Can You Contribute to a Roth IRA. Investors should consider the investment objectives risks charges and expenses of a mutual fund carefully before investing. The new tables are not effective until 2022.

If you turn 70 12 after January 1 2020. Download a prospectus or summary prospectus if available that contains this and other information about the fund and read it carefully before investing. You can find the distribution period using the IRSs Joint Life and Last Survivor Expectancy Worksheet if your spouse is the sole beneficiary and is more than 10 years younger than you or the Uniform Lifetime Worksheet for all other IRA owners.

Required Minimum Distribution Calculator. If you turned 70 12 prior to January 1 2020. Conversions are also popular Crowell said because Roth accounts provide tax-free distributions and have no minimum required distributions at age 70½.

Rmd Table Rules Requirements By Account Type

10 Ira Minimum Distribution Calculator Templates In Pdf Free Premium Templates

2

10 Ira Minimum Distribution Calculator Templates In Pdf Free Premium Templates

2

Khabar Navigating Your Required Minimum Distribution

Ira Required Minimum Distribution Worksheet Fill And Sign Printable Template Online Us Legal Forms

New Tables Are Available For Calculating Required Minimum Distributions Rmds In 2022 Julie Jason

10 Ira Minimum Distribution Calculator Templates In Pdf Free Premium Templates

2

Rmd Table Rules Requirements By Account Type

2

Required Minimum Distribution Calculator Estimate Minimum Amount

The Double Whammy Of Required Minimum Distribution In A Recession By Anthony Lawrence Pcunix Wrong Wrong Wrong Medium

10 Ira Minimum Distribution Calculator Templates In Pdf Free Premium Templates

Ira Required Minimum Distribution Worksheet Traditional Ira Pdf4pro

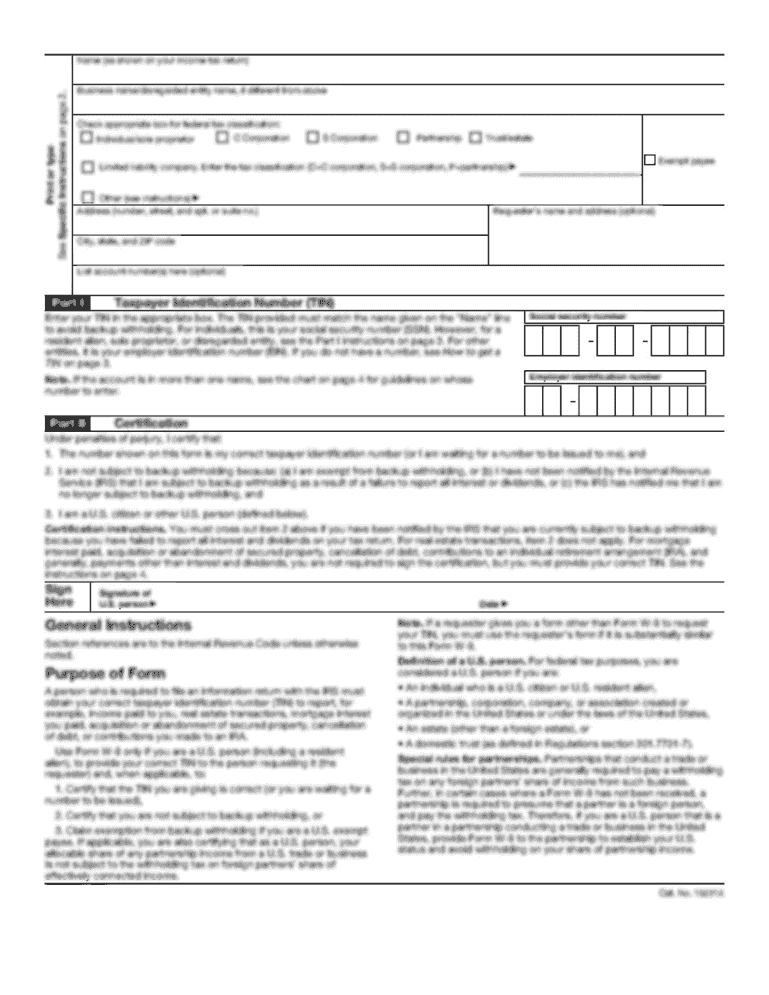

Irs Ira Distribution Fill Online Printable Fillable Blank Pdffiller