37+ mortgage loan denied in underwriting

Lets discuss what underwriters look for in the loan approval process. Respond to any requests for additional information from the underwriter.

Can A Mortgage Be Revoked After Funding

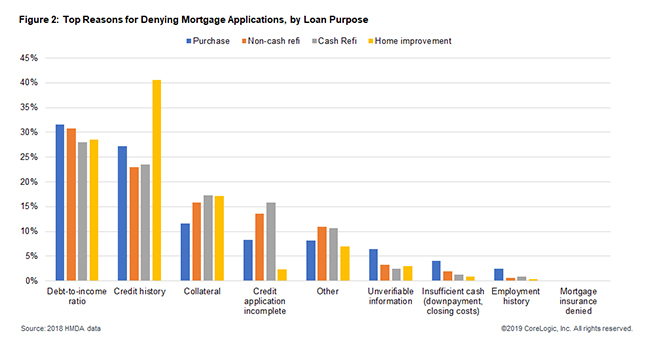

This rate is constant across home purchase loans refinancing loans and home improvement loans.

. Your Credit Score Is Too Low A low credit score might indicate that you may have trouble making on-time payments or handling the financial responsibilities. Web A mortgage underwriter is the person that approves or denies your loan application. Web Now that you know a bit more about what information underwriters look for when they assess your loan application heres what happens during the underwriting process.

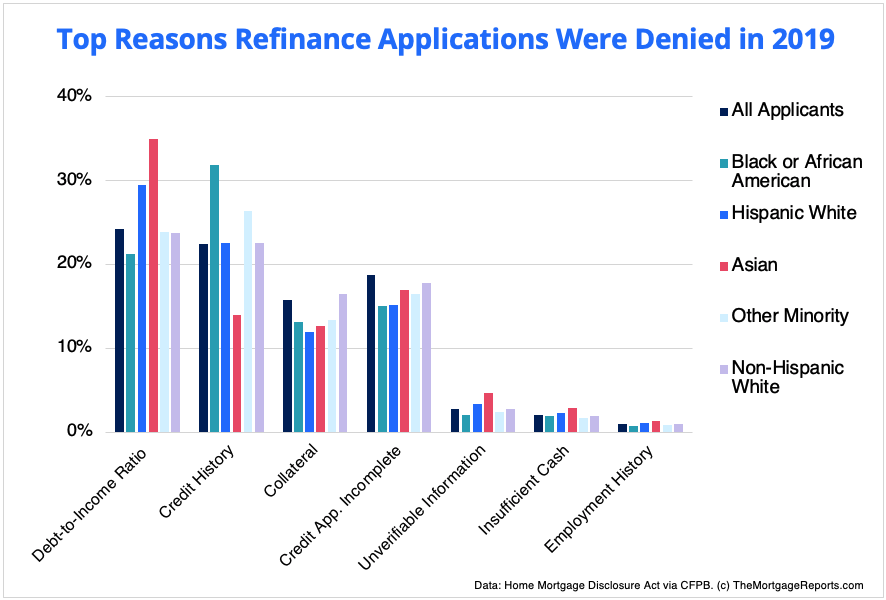

The data also showed that Black and Hispanic applicants faced higher denial rates for home loan applications at 181 and 125 respectively while 69 of non-Hispanic white applicants and 97 of Asian applicants were denied. Web Mortgage refinance applications were denied at an even higher rate of 132. Most lenders will be happy to explain why you were denied and in some cases they may be required to disclose their reasons.

Get Instantly Matched With Your Ideal Housing Loan. So I robbed Peter to knock off Paul. Web Most mortgage lenders wont approve a loan for more than the homes value so appraisal issues can lead to mortgage loan denial even if youve already been preapproved.

At any rate we have had squeaky clean since Jan 2012. Mortgage denials can also vary significantly based on demographics. Ad Use Our Comparison Site Find Out Which Hpuse Loan Suits You The Best.

Web We got denied in underwriting. Improve your credit score. Ad Compare Top Lenders For Your Mortgage Pre Approval Here Get Rates Apply Easily Online.

The 60 and 90 day lates were stupid but necessary when a vehicle broke down with a costly repair and then was paid off. According to the data Black and Latino applicants were denied a home-purchase loan at a. Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

Web Find out why. Over 37 of denied applications had a low DTI as a reason for denial. Web Heres what to expect.

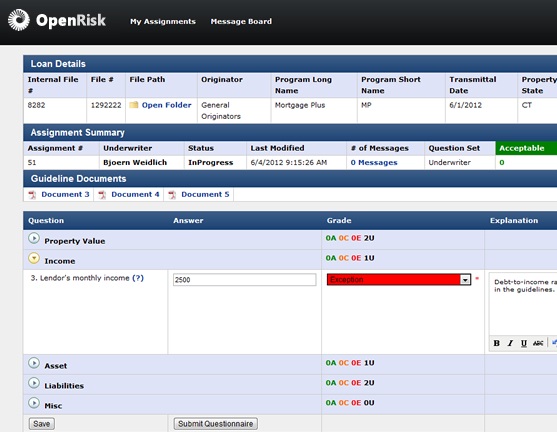

A conditional approval happens when most everything in your loan application looks good but there are a few conditions that must be met before you can get final approval. Apply for a mortgage. The first step is filling out an application online over the phone or in person.

Web If you fail to meet specific criteria such as low credit score the debt-to-income ratio DTI is too high the Loan-To-Value Ratio LTV is too high or your employment status has recently changed the underwriter can decline your application How the loan underwriting process protects lenders. You might even try asking for advice. The denial rate varies by loan type.

A low debt-to-income ratio DTI is the number one reason that mortgage applications are denied. Wait for the underwriter to review your application. If you dont know what you did wrong youre doomed to repeat it.

First the underwriter will make a reasonable effort to ensure that you have the ability to repay the mortgage based on the terms of the loan. In considering your application they look at a variety of factors including your credit history income and any outstanding debts. Raising your credit.

FHA loans take an average of 55 days to close. Web Mortgage underwriters deny about one in every 10 mortgage loan applications. Web Detailed Findings Methodology.

For example if you want to borrow 150000 and the appraisal indicates the home is only worth 140000 your application may be denied. In the last 12 mos-16-30 day lates 3-60 day lates and 2-90 day lates. Web 8 Reasons Why Mortgage Loans Are Denied In Underwriting The following are several common reasons why underwriters deny loans and how you can help prevent them from happening.

Web When you apply for this type of mortgage the underwriter will make sure that your application meets both the lenders standards as well as the standards set forth by the FHA. Web Refinance loans. Save Real Money Today.

Talk to the loan officer about the application. This is often because the applicant has too much debt a spotty employment history or a low appraisal report. For example in 2020 around 141 of FHA loans were denied during underwriting while just 76 of conventional loans were denied.

When you apply for a mortgage youre giving your lender permission to pull your credit look over your financial information order an appraisal on the home and start a title search. For home purchases the average is 54 days. Web About 9 of all mortgages were denied during the underwriting phase in 2020 according to the Consumer Financial Protection Bureau.

Web At the end of the mortgage underwriting process your loan will be approved denied or conditionally approved. Save Time Money. A review of your finances.

Web Submit your underwriting paperwork to your loan officer. However by knowing what an underwriter reviews you can make your application as attractive as possible. For refinances its 59 days.

Why The Underwriter Denied Your Mortgage Loan Mortgages And Advice U S News

Why Mortgages Are Declined 50 Reasons You Might Be Denied A Home Loan

Why The Underwriter Denied Your Mortgage Loan Mortgages And Advice U S News

Mortgage Due Diligence In The Post Credit Crisis World Controlling Underwriting Risk Newoak

May 28 By Mdcoastdispatch Issuu

Mortgage Denial Stats By Race What We Can Learn Mortgage Rates Mortgage News And Strategy The Mortgage Reports

How To Avoid Mortgage Loan Denial By Underwriters Youtube

Pdn20111230c By Peninsula Daily News Sequim Gazette Issuu

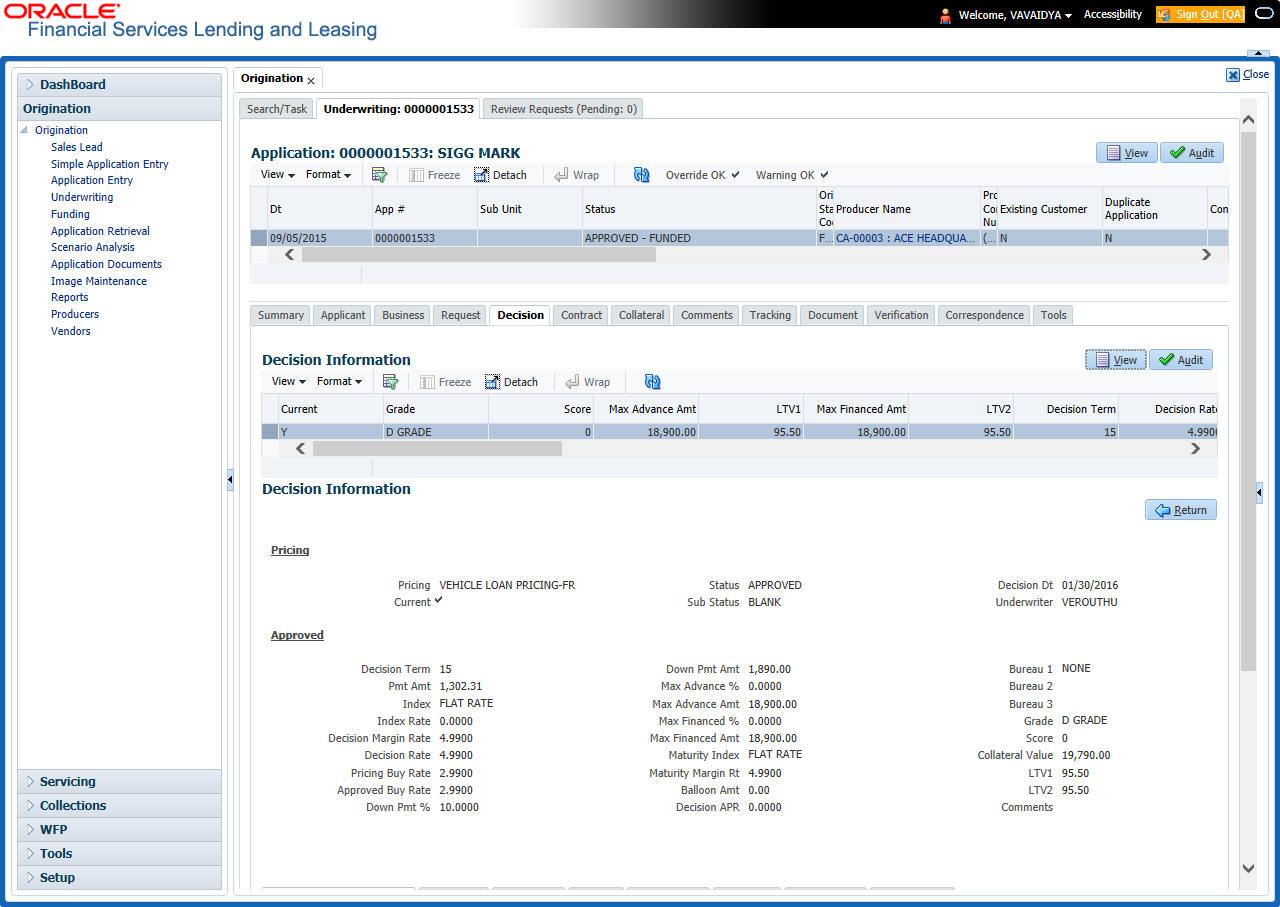

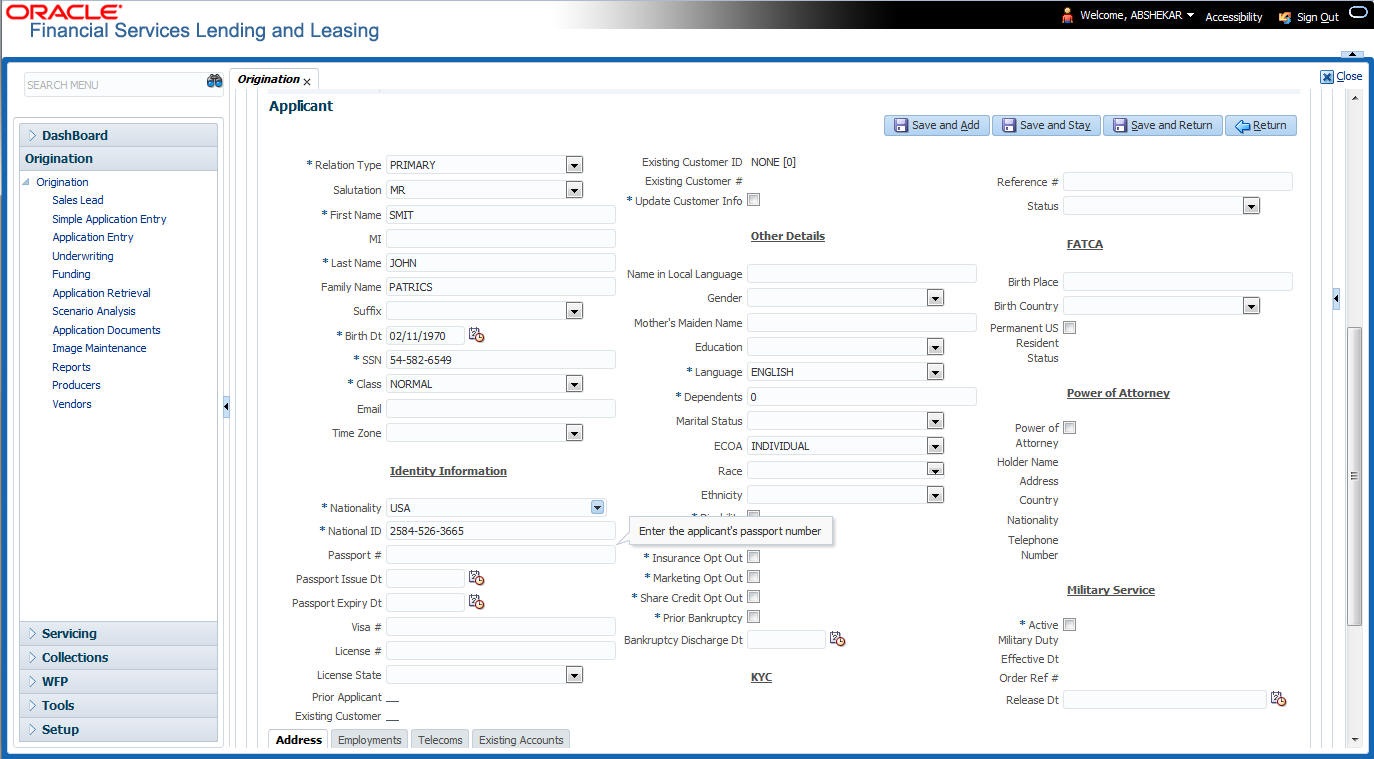

7 Underwriting

7 Underwriting

Top Reasons Underwriters Deny Mortgage Loans Quicken Loans

How Long Does It Take To Close On A House

Why The Underwriter Denied Your Mortgage Loan Mortgages And Advice U S News

Why Mortgage Applications Are Declined Max Loans

:max_bytes(150000):strip_icc()/Underwriting-8dc4a438cf2647ec853a229b86fced42.jpeg)

What Can Go Wrong In Underwriting

Jwedqa1252dtnm

How To Avoid Mortgage Loan Denial By Underwriters